Overview

The Element Resources Funds

Element has been established to provide investors with exposure to resources projects in a variety of Eurasian and a select number of north African countries. The Fund provides diversity of commodity, geography and investment across the development spectrum from early stage to production.

The Fund uses a mixed of staged investing, portfolio diversification, investment structuring (use of convertible notes etc) and thorough due diligence to manage risk. Investments are preferably in direct equity and hybrid investment structures.

Commodity

The Fund will develop a diversified portfolio across precious metals (20%-50%), base metals (20%-50%), industrial / speciality metals (20%-40%) and bulk commodities (0%-20%). The Fund does not invest in uranium or thermal coal.

Investment Team

The Investment Team has a strong background in resource investment which includes identification of opportunities, due diligence and importantly the capacity to execute investment. Prior fund investments have been made globally in a wide variety of commodities and in various investment structures in both public and private companies.

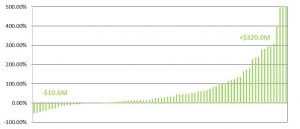

Performance Record

| Period | Average Compound Return | Fund Size |

|

| Fund 1 | 1997 – 2002 | 30.00% | A$63m |

| Fund 2 | 2003 – 2004 | 38.37% | A$39m |

| Fund 3 | 2005 – 2008 | 33.29% | A$140m |

| Fund 4 |

2011 – 2014 | > 30.00% | A$20m |

| Fund 5 |

1999 – 2011 | 29% | US$29m |

| Fund 6 |

2004 – 2016 | 20% | US$35m |

| Fund 7 |

2008 – | Active | US$79m |

Picking Winners

Strategy

Objective

The Element Resources Fund seeks to generate superior returns through investment in resources companies with projects in the Element Countries of Operation.

Strategy

The Fund will identify suitable investment opportunities thorough its broad industry network and following a due diligence process will look to invest in certain of these through a mix of equity or equity-related instruments. These companies will have been identified as having the potential for value re-rating as they progress up the development curve or exhibit strong growth potential in their key asset.

The Fund will seek to reduce the risk through a number of means including portfolio diversification in terms of geography, commodity and investment structure. The Fund will seek to mitigate risk through its due diligence process, the input of its Investment Advisory Committee, the structuring of investments and where required, input at the management level in the investee companies.

The Manager

The Fund Manager is headquartered in Perth, Australia, with offices in Melbourne, Almaty and London. It is the holder of an Australian Financial Services Licence (No 311835).

The management team has a long involvement in the entire process of investment in small and medium capitalised resources companies across the globe. This includes the sourcing, due diligence, structuring, execution and realisation of investments.

The experience of the Manager in resources investment over a long period has provided some key pointers in how to optimise investment in small and mid-cap resources companies. These include:

- Thorough due diligence

- Comfort on the management of the investee company

- Use of staged investment provides risk mitigation

- Be prepared to be flexible in the investment approach

- Early investment on a modest scale often affords the fund a preferred investor status

- Use of hybrids is useful in risk mitigation

- It is often useful to have other like-minded funds participate in the investee companies as they grow.

- Be prepared to lock some profits in along the way.

- Possible board representation or assistance with operations where required.

Nature of Investments and Investment Size

The majority of the investments will be made in companies with market capitalisations of between $10m and $250m at the time of initial investment.

Investments may be in the private or public space and up to 10% of the committed capital of the fund.

Risk Management

Element has a strong focus on risk management in the investment decision process and thereafter using tailored investment structures appropriate for the risk and opportunities, staged investments and active portfolio management.

Due Diligence

A key requirement for successful resource investment is the due diligence process. The Manager has a comprehensive list of aspects which are investigated as part of its due diligence process. This following list provides some insight into the criteria which are reviewed, although the list will be supplemented in other areas as required.

- Portfolio Guidelines

- Geopolitics

- Management Team

- Technical – Geology Mining Processing

- Exploration and future growth

- Legal, Financial

- Management and Control

- Economic Valuation, Peer comparison Sensitivity Analysis.

- Environment and Social Factors

- Proposed investment Structure

Investment Structures

Investments are structured to reflect the risks and opportunities associated with each investment opportunity. Structures include equity, direct equity, debt, hybrid securities and other structures. Whilst these investments will generally be made in publicly listed entities (across global markets), they may include private transactions.

Value Add

The Element team understands what is required to grow junior companies. Element Fund involvement can include Board or other roles as required – it is a team that is prepared to “roll its sleeves up” and work alongside management. The Element Team has been involved in many junior companies and can apply the many lessons learned through multiple investment cycles.

Contacts

Element’s experience and networks in the global mining and financial industries, Element frequently provides useful contacts and introductions to assist portfolio companies achieve their goals.